Table of Contents

ToggleMastering the Cup and Handle Pattern: A Comprehensive Guide

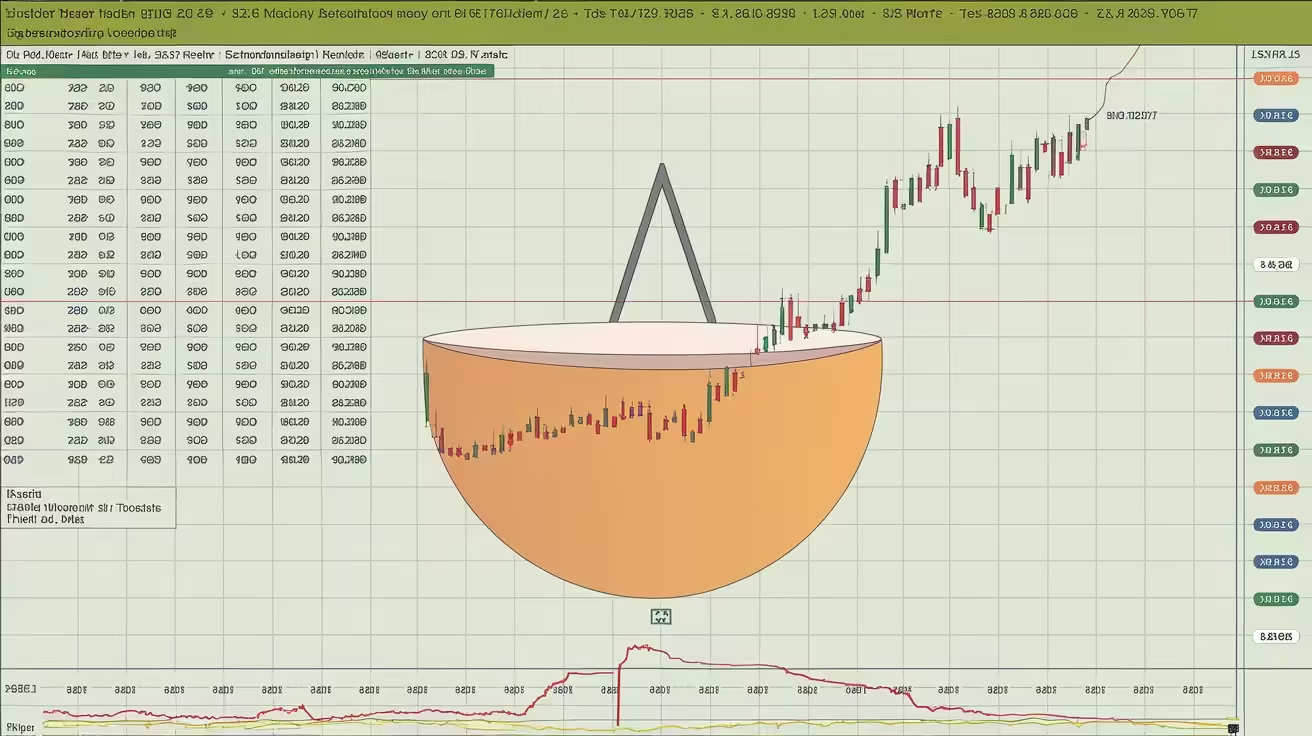

The stock market can seem like a labyrinth of numbers, charts, and patterns, but for those who are well-versed in technical analysis, these elements offer invaluable insights. Among the myriad of chart patterns, the cup and handle pattern stands out as a powerful indicator of potential bullish trends. This pattern is favored by many traders for its reliability in signaling the continuation of an uptrend. Understanding this pattern, how it forms, and how to trade it can give investors a significant edge in the market.

What is the Cup and Handle Pattern?

The cup and handle pattern is a bullish continuation pattern that indicates a pause followed by a breakout in an uptrend. Named for its visual resemblance to a teacup, the pattern consists of two main parts: the cup, which forms after a period of consolidation, and the handle, a small downward correction before the breakout.

The cup portion of the pattern looks like a rounded U-shape, reflecting a period of consolidation where the price moves sideways with a slight downward drift, followed by a recovery to its previous high. This stage shows that the market is slowly absorbing selling pressure. After the cup forms, the handle begins, characterized by a short pullback or sideways movement, representing the final shakeout of weak hands before the price resumes its upward trajectory.

Historical Background and Importance

The cup and handle pattern was popularized by William O’Neil, the founder of Investor’s Business Daily, in his 1988 book “How to Make Money in Stocks.” O’Neil identified this pattern as one of the most reliable setups for trading stocks, especially when combined with strong fundamentals and positive market sentiment. Over the years, this pattern has gained immense popularity among traders due to its consistent success in predicting significant price movements.

This pattern is not just limited to stocks; it can also be applied to other financial instruments such as commodities, forex, and cryptocurrencies. The ability to recognize and trade the cup and handle pattern allows traders to capitalize on profitable opportunities in a variety of markets.

Anatomy of the Cup and Handle Pattern

Understanding the individual components of the cup and handle pattern is crucial for identifying and trading it effectively. Let’s break down the pattern into its two primary phases:

The Cup

- Formation: The cup forms after a period of decline in the price, which eventually finds support and begins to recover. The depth of the cup can vary, but it generally should not exceed 50% of the previous uptrend. A deeper cup might indicate a less reliable pattern.

- Shape: The ideal cup has a rounded, U-shaped bottom. This suggests that the selling pressure gradually decreases and the buying interest slowly returns, creating a smooth transition from decline to recovery.

- Volume: During the formation of the cup, trading volume typically decreases as the price declines and then gradually increases as the price starts to rise again. This volume pattern indicates that selling pressure is waning, and buyers are stepping back in.

The Handle

- Formation: Once the cup is formed, the price often pulls back slightly, creating the handle. This pullback should be shallow, generally retracing no more than 15% to 20% of the cup’s height. A deep handle might weaken the pattern and reduce the likelihood of a successful breakout.

- Shape: The handle can take various forms, such as a sideways consolidation or a downward-sloping channel. A handle that slopes downward slightly is considered healthier, as it indicates a final shakeout of weak hands before the uptrend resumes.

- Volume: During the formation of the handle, volume typically decreases, indicating that selling pressure is diminishing. A breakout from the handle should be accompanied by a significant increase in volume, confirming the strength of the move.

Why the Cup and Handle Pattern Works

The effectiveness of the cup and handle pattern lies in its ability to represent the psychology of the market. The pattern reflects a market that is first digesting a previous move (forming the cup) and then shaking out any remaining sellers (forming the handle) before launching into a new uptrend. This series of events often results in a strong and sustained breakout.

Psychological Significance

- Cup Formation: The cup phase represents a period of consolidation where the market absorbs selling pressure. Sellers who are eager to exit do so during the initial decline, and once they are exhausted, buyers begin to step in, leading to a gradual recovery. The rounded bottom of the cup shows that the market is building a base and preparing for a move higher.

- Handle Formation: The handle formation is a crucial part of the pattern. It represents a final shakeout, where remaining weak holders sell their positions, allowing stronger hands to take control. This process creates a more solid foundation for the subsequent breakout.

Confirmation of Breakout

The true confirmation of the cup and handle pattern comes when the price breaks above the resistance level formed by the cup’s rim. This breakout should be accompanied by an increase in volume, signaling that the market has accepted the higher prices and is ready to move higher.

Identifying the Cup and Handle Pattern

To successfully trade the cup and handle pattern, traders must be adept at identifying the pattern in real-time. While it may seem straightforward, there are several nuances to consider when spotting this pattern on a chart.

Steps to Identify the Pattern

- Step 1: Identify the Cup: Look for a rounded bottom on the chart, which forms after a price decline. Ensure that the cup is not too deep, as a shallow cup is more indicative of a healthy consolidation period.

- Step 2: Spot the Handle: After the cup completes, watch for a slight pullback or consolidation, forming the handle. This should be relatively shallow and occur near the upper end of the cup.

- Step 3: Volume Analysis: Check the volume patterns during the formation of the cup and handle. A decrease in volume during the cup’s decline, followed by an increase during the recovery, and a further drop during the handle, is ideal. The breakout from the handle should see a surge in volume.

- Step 4: Confirm the Breakout: Once the handle is complete, wait for the price to break above the resistance level formed by the cup’s rim. This breakout should be confirmed with strong volume, indicating that the market is ready to move higher.

Common Mistakes When Trading the Cup and Handle Pattern

While the cup and handle pattern is a powerful tool, it is not foolproof. Traders often make mistakes when identifying or trading this pattern, which can lead to suboptimal results. Being aware of these pitfalls can help traders improve their success rates.

Overlooking the Depth of the Cup

One common mistake is trading a pattern with a cup that is too deep. A deep cup indicates that the preceding sell-off was too severe, and the subsequent recovery may not be strong enough to sustain a significant breakout. Ideally, the cup should retrace no more than 50% of the preceding uptrend.

Ignoring the Handle’s Shape and Volume

The handle is a critical component of the pattern, and its characteristics can make or break the trade. A handle that is too deep or formed on low volume might indicate a weak pattern. Traders should ensure that the handle is shallow and that the breakout occurs with strong volume to confirm the pattern’s validity.

Entering the Trade Prematurely

Another mistake is entering the trade before the breakout is confirmed. The cup and handle pattern is not complete until the price breaks above the resistance level formed by the cup’s rim. Entering the trade too early can expose traders to false breakouts and unnecessary losses.

Not Using Stop-Loss Orders

Even the most reliable patterns can fail, which is why using stop-loss orders is essential when trading the cup and handle pattern. Placing a stop-loss just below the handle or the cup’s bottom can protect traders from significant losses if the pattern fails to materialize.

Trading the Cup and Handle Pattern

Once the cup and handle pattern has been identified, traders can employ various strategies to capitalize on the impending breakout. Successful trading requires not only identifying the pattern but also understanding the nuances of entry, exit, and risk management.

Entry Strategies

- Buy on Breakout: The most common strategy is to buy when the price breaks above the resistance level formed by the cup’s rim. This breakout should be confirmed with strong volume. Entering at this point allows traders to capitalize on the momentum that typically follows a successful breakout.

- Aggressive Entry: Some traders prefer to enter the trade during the formation of the handle, anticipating the breakout. While this strategy can lead to higher profits, it also carries more risk, as the breakout is not yet confirmed.

Exit Strategies

- Profit Targets: A common method for setting a profit target is to measure the depth of the cup and project that distance upward from the breakout point. This gives traders a reasonable estimate of how far the price might move after the breakout.

- Trailing Stops: Using a trailing stop allows traders to lock in profits as the price moves higher while giving the trade room to grow. A trailing stop can be set at a percentage or dollar amount below the current price, adjusting as the price advances.

Risk Management

Risk management is crucial when trading any pattern, and the cup and handle pattern is no exception. Traders should always use stop-loss orders to protect against significant losses. A stop-loss can be placed just below the handle or the bottom of the cup, depending on the trader’s risk tolerance.

Position sizing is another important aspect of risk management. Traders should never risk more than a small percentage of their trading capital on a single trade. By keeping risk under control, traders can survive losing trades and remain in the game long enough to capitalize on winning trades.

Real-World Examples of the Cup and Handle Pattern

Seeing the cup and handle pattern in action can help traders gain a deeper understanding of how it works and how to trade it effectively. Let’s look at a few real-world examples of this pattern in different markets.

Example 1: Apple Inc. (AAPL)

In 2019, Apple Inc. (AAPL) formed a textbook cup and handle pattern on its daily chart. The stock had been in an uptrend, followed by a period of consolidation that formed the cup. After the cup was completed, the stock pulled back slightly, forming the handle. The breakout above the resistance level formed by the cup’s rim was accompanied by a surge in volume, leading to a strong upward move.

Example 2: Gold (XAU/USD)

In the commodities market, the cup and handle pattern can also be found. In 2020, gold (XAU/USD) formed a cup and handle on its weekly chart. The cup was formed during a period of consolidation after a significant rally in gold prices. The handle followed, with a slight pullback before the price broke out to new highs. The breakout was confirmed by strong volume, leading to a sustained rally in gold prices.

Example 3: Bitcoin (BTC/USD)

Cryptocurrencies are known for their volatility, and the cup and handle pattern can be particularly powerful in these markets. In 2021, Bitcoin (BTC/USD) formed a cup and handle on its daily chart. After a sharp decline, Bitcoin found support and began to recover, forming the cup. The handle followed, with a brief pullback before the price broke out to new highs. The breakout was accompanied by a significant increase in volume, leading to a strong rally in Bitcoin prices.

Advantages and Limitations of the Cup and Handle Pattern

Like any trading strategy, the cup and handle pattern has its advantages and limitations. Understanding these can help traders make informed decisions about when and how to use this pattern.

Advantages

- High Success Rate: When properly identified and traded, the cup and handle pattern has a high success rate, making it a favorite among technical traders.

- Versatility: The pattern can be applied to various markets, including stocks, commodities, forex, and cryptocurrencies.

- Clear Entry and Exit Points: The pattern provides clear entry and exit points, helping traders manage risk effectively.

Limitations

- Time Frame Dependency: The pattern can take a long time to form, especially on higher time frames. Traders need to be patient and wait for the pattern to complete before entering a trade.

- False Breakouts: Like any pattern, the cup and handle pattern is not foolproof and can result in false breakouts. Traders need to be cautious and use volume confirmation to avoid false signals.

- Market Conditions: The pattern works best in bullish market conditions. In a bearish market, the pattern is less likely to result in a successful breakout.

Frequently Asked Questions about the Cup and Handle Pattern

What is the cup and handle pattern?

The cup and handle pattern is a bullish continuation pattern in technical analysis that signals a potential breakout after a period of consolidation. It consists of a rounded “cup” followed by a slight pullback or sideways movement called the “handle.”

How do you identify the cup and handle pattern?

To identify the cup and handle pattern, look for a rounded bottom (the cup) on the chart followed by a slight pullback or consolidation (the handle). The pattern is confirmed when the price breaks above the resistance level formed by the cup’s rim, ideally with strong volume.

What are the key characteristics of the cup and handle pattern?

The key characteristics of the cup and handle pattern include a rounded U-shaped cup, a shallow handle that retraces no more than 15% to 20% of the cup’s height, and a breakout above the resistance level formed by the cup’s rim, confirmed by an increase in volume.

How reliable is the cup and handle pattern?

The cup and handle pattern is considered highly reliable, especially when combined with strong volume confirmation and bullish market conditions. However, like any trading strategy, it is not foolproof and should be used in conjunction with other technical analysis tools and risk management practices.

Can the cup and handle pattern be used in different markets?

Yes, the cup and handle pattern can be applied to various markets, including stocks, commodities, forex, and cryptocurrencies. Its versatility makes it a valuable tool for traders across different asset classes.

What are common mistakes when trading the cup and handle pattern?

Common mistakes when trading the cup and handle pattern include trading a pattern with a cup that is too deep, ignoring the handle’s shape and volume, entering the trade prematurely before the breakout is confirmed, and not using stop-loss orders to manage risk.

Conclusion

The cup and handle pattern is a powerful tool in the arsenal of any technical trader. Its ability to signal the continuation of an uptrend after a period of consolidation makes it a reliable indicator for bullish breakouts. By understanding the anatomy of the pattern, recognizing its psychological underpinnings, and employing sound trading strategies, traders can effectively leverage this pattern to capture profitable opportunities in the market.

However, like any trading strategy, the cup and handle pattern requires careful analysis, patience, and risk management. By avoiding common mistakes and adhering to best practices, traders can enhance their chances of success and achieve their trading goals.

For more information regarding Finance Basic you can visit FinancewithAi Channel & Home

Trading Chart Patterns: 7 Proven Strategies for Guaranteed Success

Head and Shoulder Pattern: 7 Powerful Strategies for Successful Trading

Inverse Head and Shoulders Pattern: 5 Proven Tips for Bullish Reversals

Share this:

- Click to share on LinkedIn (Opens in new window)

- Click to share on Reddit (Opens in new window)

- Click to share on Tumblr (Opens in new window)

- Click to share on Pinterest (Opens in new window)

- Click to share on Pocket (Opens in new window)

- Click to share on Telegram (Opens in new window)

- Click to share on Threads (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

- Click to share on Mastodon (Opens in new window)

- Click to share on Nextdoor (Opens in new window)

- Click to share on Bluesky (Opens in new window)