The Ultimate Guide to Candlestick Patterns PDF: Unlocking Trading Success

Candlestick patterns are the cornerstone of technical analysis in trading, offering invaluable insights into market sentiment and potential price movements. For traders, both novice and experienced, understanding these patterns can be the difference between success and failure in the market. This article provides a comprehensive guide on candlestick patterns and how to effectively use a candlestick patterns PDF as a tool in your trading arsenal.

Understanding Candlestick Patterns PDF: A Trader’s Best Friend

Candlestick patterns are graphical representations of price movements in a given time period. Each candlestick shows four key pieces of information: the opening price, closing price, highest price, and lowest price. Traders use these patterns to identify potential market reversals, continuations, and trends. A candlestick patterns PDF serves as a portable and easy-to-access reference for these patterns, making it an indispensable resource for traders.

Why Candlestick Patterns Are Essential for Traders

Candlestick patterns offer a visual insight into market psychology, reflecting the battle between buyers and sellers. Understanding these patterns allows traders to anticipate future price movements based on historical data. A well-crafted candlestick patterns PDF can help traders quickly recognize these patterns and apply them in real-time trading scenarios.

Hanging Man Candle: Master 3 Profitable Trading Strategies

How to Use a Candlestick Patterns PDF for Maximum Effectiveness

A candlestick patterns PDF can be used in several ways to enhance trading strategies:

- Quick Reference Guide: During trading sessions, having a PDF guide handy allows for quick identification of patterns without the need to memorize each one.

- Educational Tool: For beginners, a candlestick patterns PDF serves as a learning tool, helping them understand the significance of different patterns.

- Strategy Development: Advanced traders can use the PDF to develop and refine their trading strategies by backtesting various patterns.

The Anatomy of a Candlestick

Before diving into specific candlestick patterns, it’s crucial to understand the basic structure of a candlestick. Each candlestick consists of the following components:

- The Body: The body of the candlestick represents the range between the opening and closing prices. A filled or colored body indicates that the closing price was lower than the opening price, while an unfilled or hollow body indicates that the closing price was higher than the opening price.

- The Wick (or Shadow): The lines extending from the body are called wicks or shadows. The upper wick shows the highest price during the period, while the lower wick shows the lowest price.

- The Real Body vs. The Wick: The size of the real body compared to the wicks can indicate the strength of the price movement. A long body suggests strong momentum, while long wicks may indicate indecision in the market.

Dragonfly Doji Candlestick: 7 Powerful Reasons It Signals a Positive Market Reversal

Key Candlestick Patterns Every Trader Should Know

Candlestick patterns are categorized into two main types: single-candle patterns and multi-candle patterns. Both types provide valuable insights into potential market direction.

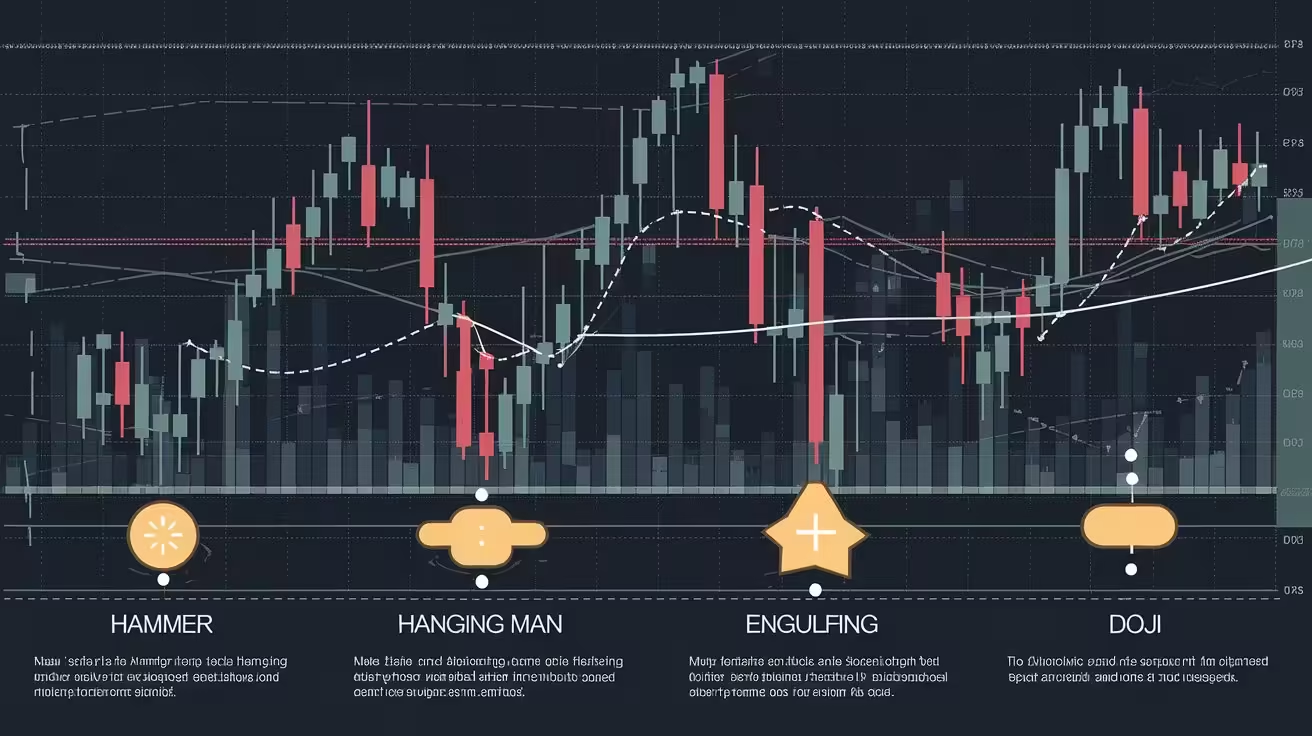

Single-Candle Patterns

- Doji: A Doji candlestick forms when the opening and closing prices are virtually equal, resulting in a very small or non-existent body. This pattern indicates indecision in the market and can signal a potential reversal when seen in an uptrend or downtrend.

- Hammer: The hammer is a bullish reversal pattern characterized by a small body and a long lower wick. It occurs after a downtrend and suggests that sellers were unable to sustain lower prices, leading to a potential upward reversal.

- Shooting Star: The shooting star is the bearish counterpart to the hammer. It has a small body and a long upper wick, occurring after an uptrend. This pattern indicates that buyers pushed the price higher, but sellers regained control, potentially leading to a downward reversal.

Multi-Candle Patterns

- Engulfing Patterns: These patterns involve two candlesticks where the second candlestick’s body completely engulfs the first. A bullish engulfing pattern occurs at the end of a downtrend and signals a potential reversal, while a bearish engulfing pattern occurs at the end of an uptrend.

- Morning Star: The morning star is a three-candle pattern that signals a bullish reversal. It consists of a long bearish candle, followed by a small-bodied candle (which can be bullish or bearish), and then a long bullish candle. This pattern indicates that selling pressure is waning, and buying pressure is increasing.

- Evening Star: The evening star is the bearish counterpart to the morning star. It is a three-candle pattern consisting of a long bullish candle, a small-bodied candle, and a long bearish candle. This pattern suggests that buying pressure is weakening and selling pressure is gaining momentum.

10 Powerful Candlestick Patterns Cheat Sheet for Ultimate Trading Success

Candlestick Patterns PDF: A Comprehensive Resource for Traders

A well-organized candlestick patterns PDF includes detailed descriptions and illustrations of all major patterns. This makes it an invaluable tool for traders who want to quickly identify and apply these patterns in their trading strategy.

How to Download and Use a Candlestick Patterns PDF

Many financial websites and trading platforms offer free or paid candlestick patterns PDFs. These resources can be downloaded to your computer or mobile device for easy access. When selecting a candlestick patterns PDF, look for one that is comprehensive, well-illustrated, and easy to understand.

Integrating Candlestick Patterns into Your Trading Strategy

Simply having a candlestick patterns PDF is not enough; traders must know how to effectively integrate these patterns into their overall trading strategy.

Using Candlestick Patterns for Entry and Exit Points

Candlestick patterns can be used to determine optimal entry and exit points in the market. For example, a bullish engulfing pattern may signal a good entry point for a long position, while a shooting star may indicate an ideal exit point.

Combining Candlestick Patterns with Other Technical Indicators

While candlestick patterns are powerful on their own, they are even more effective when combined with other technical indicators such as moving averages, relative strength index (RSI), and Fibonacci retracements. This combination can help confirm signals and increase the accuracy of your trades.

Candlestick Bible: Discover the 3 Secrets to Profitable Trading

Backtesting Candlestick Patterns

Before applying candlestick patterns in live trading, it’s essential to backtest them using historical data. This helps traders understand how these patterns perform in different market conditions and refine their strategies accordingly.

Common Mistakes to Avoid When Using Candlestick Patterns

Even with a comprehensive candlestick patterns PDF, traders can still make mistakes when interpreting and applying these patterns. Here are some common pitfalls to avoid:

Over-reliance on Candlestick Patterns

While candlestick patterns are powerful tools, they should not be the sole basis for trading decisions. It’s important to consider other factors such as market trends, volume, and external news events.

Morning Star Candlestick Pattern: Discover 5 Profitable Trading Strategies

Misinterpreting Patterns

Candlestick patterns can sometimes be ambiguous, leading to misinterpretation. For example, a Doji pattern can indicate either a reversal or continuation, depending on the context. It’s crucial to analyze the overall market environment before making a decision.

Ignoring the Bigger Picture

Candlestick patterns are most effective when used in conjunction with other forms of analysis, such as trend analysis and support/resistance levels. Ignoring the bigger picture can lead to false signals and poor trading decisions.

The Future of Candlestick Patterns: Evolving Strategies in a Digital World

As trading becomes increasingly digital and algorithmic, the use of candlestick patterns is also evolving. While traditional patterns remain relevant, traders are now developing new strategies that incorporate machine learning and artificial intelligence to identify patterns more accurately and execute trades more efficiently.

Algorithmic Trading and Candlestick Patterns

Algorithmic trading systems can analyze candlestick patterns at a speed and scale that human traders cannot match. These systems use complex algorithms to identify patterns in real-time and execute trades automatically. This technology is particularly useful in high-frequency trading environments where split-second decisions can make a significant difference.

Machine Learning and Pattern Recognition

Machine learning models are being developed to recognize and predict candlestick patterns with greater accuracy. These models can analyze vast amounts of data and identify subtle patterns that might be missed by the human eye. This technology is still in its early stages, but it has the potential to revolutionize the way traders use candlestick patterns.

Conclusion: Mastering Candlestick Patterns with the Right Tools

Candlestick patterns are a fundamental aspect of technical analysis and an essential tool for any trader. Whether you’re just starting or looking to refine your strategies, a well-crafted candlestick patterns PDF can provide the guidance you need to succeed in the markets.

By understanding the basic anatomy of candlesticks, recognizing key patterns, and avoiding common mistakes, you can enhance your trading strategy and make more informed decisions. As trading technology continues to evolve, staying up-to-date with the latest developments and tools, such as algorithmic trading and machine learning, will ensure that you remain competitive in the ever-changing financial markets.

So, take the time to download a comprehensive candlestick patterns PDF, study it thoroughly, and integrate these patterns into your trading strategy. With practice and discipline, you’ll be well on your way to mastering the art of candlestick trading and achieving your financial goals.

FAQs

What is a candlestick patterns PDF?

A candlestick patterns PDF is a downloadable guide that provides detailed descriptions and illustrations of various candlestick patterns used in technical analysis.

How can I use a candlestick patterns PDF in my trading strategy?

A candlestick patterns PDF can be used as a quick reference guide, an educational tool, and a resource for developing and refining trading strategies.

What are some key candlestick patterns I should know?

Some essential candlestick patterns include the Doji, Hammer, Shooting Star, Engulfing Patterns, Morning Star, and Evening Star.

Can I rely solely on candlestick patterns for trading decisions?

No, while candlestick patterns are powerful, they should be used in conjunction with other forms of analysis, such as trend analysis and technical indicators.

How can technology enhance the use of candlestick patterns?

Algorithmic trading and machine learning are advancing the way traders use candlestick patterns, enabling faster and more accurate pattern recognition and execution.

Where can I download a candlestick patterns PDF?

You can find candlestick patterns PDFs on various financial websites and trading platforms, both for free and for purchase.

For more information regarding Finance Basic you can visit FinancewithAi Channel & Home