The Ultimate Guide to Using an Annual Financial Projection Calculator for Your Business

Financial planning is the bedrock of any successful business strategy. Whether you’re a seasoned entrepreneur or a small business owner trying to navigate through uncertain times, having a clear picture of your company’s financial future is essential. The right tool to aid in this planning is an annual financial projection calculator. It enables businesses to forecast revenues, expenses, and cash flow for the upcoming year, making it easier to set realistic goals, identify potential financial challenges, and secure investment or loans.

In this article, we’ll explore the ins and outs of an annual financial projection calculator, explain why it’s crucial for your business, and how to make the most of it to ensure sustainable growth.

What is an Annual Financial Projection Calculator?

An annual financial projection calculator is a financial planning tool used by businesses to estimate their projected income, expenses, and cash flow for an entire year. By entering key data such as expected revenue, operating costs, and other financial factors, businesses can forecast their financial performance over a 12-month period. This helps in creating a financial road map for the year, allowing companies to manage budgets more effectively, plan for growth, and avoid potential financial pitfalls.

It’s not just limited to businesses. Individuals can also use a financial projection calculator to forecast personal finances, especially if they have multiple income streams or are managing various expenses.

Why is Financial Forecasting Important?

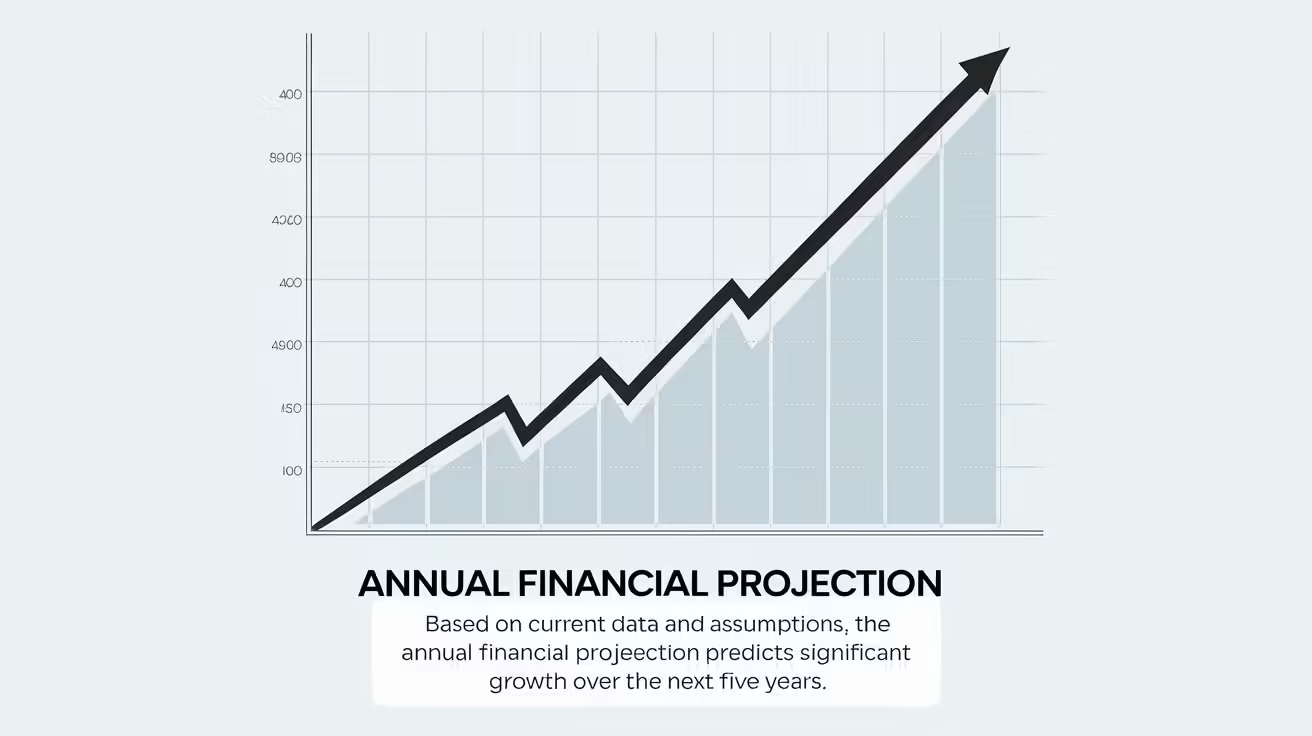

Financial forecasting is an integral part of business planning. It allows companies to make informed decisions, mitigate risks, and seize opportunities. The annual financial projection calculator provides a visual representation of your expected financial performance, helping you understand whether you are on track to meet your goals or if adjustments are necessary. Podcasts That Will Increase Your Financial Literacy: Discover 5 Must-Listen Shows .

Some key benefits of financial forecasting include:

- Better Budgeting: By predicting future income and expenses, you can allocate resources more effectively.

- Improved Cash Flow Management: Forecasting helps in identifying periods of potential cash flow shortages, allowing businesses to take preemptive action.

- Attracting Investors and Securing Loans: Financial projections are often required when seeking investment or applying for loans, as they show your business’s potential for growth.

- Setting Realistic Goals: Having clear financial targets helps businesses stay focused and achieve realistic objectives.

- Identifying Weaknesses: Forecasts can highlight financial risks, such as rising expenses or declining revenues, allowing businesses to correct course before problems become critical.

How Does an Annual Financial Projection Calculator Work?

The annual financial projection calculator operates by taking into account several key inputs to estimate your financial performance for the year. These inputs typically include:

- Revenue Projections: Estimating your total sales or income for the year based on past performance, market trends, and growth expectations.

- Operating Costs: This includes all the day-to-day expenses needed to run your business, such as wages, rent, utilities, and other overheads.

- Capital Expenditures: Any significant investments or purchases that you plan to make during the year, such as new equipment, technology upgrades, or facility expansions.

- Debt Repayment: If your business has any outstanding loans or debts, it’s crucial to factor in the repayment schedules to avoid cash flow problems.

- Tax Obligations: Calculating the taxes that you’ll need to pay throughout the year based on your projected income.

- Miscellaneous Expenses: Any other costs that are specific to your industry or business model.

After inputting these figures, the annual financial projection calculator will generate a comprehensive projection report that includes your expected income, expenses, profits, and cash flow for each month or quarter. This gives you a clear picture of your financial position throughout the year.

Steps to Use an Annual Financial Projection Calculator

Using an annual financial projection calculator might seem intimidating at first, but it’s a straightforward process once you break it down into steps. Here’s a simple guide to get you started:

Step 1: Gather Historical Data The first step in financial forecasting is gathering your previous year’s financial statements. This includes your income statement, balance sheet, and cash flow statement. By analyzing these records, you can better estimate your future revenue and expenses. If you’re a new business, use industry averages or market research to make educated guesses.

Step 2: Set Financial Goals Before using the calculator, it’s important to have a clear understanding of your financial objectives. Do you want to increase revenue by 15%? Or perhaps reduce operating costs by 10%? Setting specific, measurable goals will help you fine-tune your projections.

Step 3: Enter Revenue Projections Based on your historical data and market conditions, estimate how much income you expect to generate over the next 12 months. If you have multiple revenue streams, break them down by category, such as product sales, services, or subscriptions.

Step 4: Input Fixed and Variable Costs List all your regular operating expenses. Fixed costs remain constant (like rent), while variable costs change based on your business activity (like production costs). Be thorough in this step to avoid any surprises.

Step 5: Factor in Debt and Taxes Include any loan repayments, interest payments, and estimated taxes in your financial projection. These are non-negotiable expenses, so it’s important to account for them accurately.

Step 6: Review and Adjust Once you’ve entered all the necessary information, review your projections. Are your profit margins realistic? Is your cash flow sufficient to cover your expenses? Make adjustments as needed and use this projection as a blueprint for your business.

The Importance of Accuracy in Financial Projections

Using an annual financial projection calculator provides valuable insights into your business’s future, but the accuracy of those projections is paramount. Overly optimistic or unrealistic projections can lead to serious financial mismanagement. Money 6x reit holdings: Unlock the Secret to Exponential Growth.

- Avoiding Over-Estimations: One of the most common mistakes businesses make when creating financial projections is overestimating revenue while underestimating expenses. This can lead to a cash flow crunch, leaving the business unable to meet its financial obligations.

- Contingency Planning: Always build a buffer into your projections by adding a contingency for unexpected costs. Whether it’s a sudden increase in raw material prices or an unforeseen regulatory expense, having a financial cushion can keep your business afloat.

- Reviewing Projections Regularly: Financial projections shouldn’t be a one-time exercise. As market conditions change, regularly updating your projections ensures that your business remains on course and can pivot when necessary. Mortgage Recast Calculator: Your Tool for Financial Savings 101 .

Key Features of an Annual Financial Projection Calculator

Modern financial projection calculators come with a variety of features designed to simplify the forecasting process. Some of the most useful features include:

- Scenario Analysis: This allows you to create different financial projections based on various scenarios. For instance, you could create one projection assuming a 10% increase in revenue and another assuming a 5% decline.

- Cash Flow Analysis: Cash flow is the lifeblood of any business. An annual financial projection calculator helps you track cash inflows and outflows, ensuring that you have enough liquidity to cover operating expenses.

- Automated Calculations: The calculator automatically performs complex financial calculations, saving you time and reducing the risk of errors.

- Visualization Tools: Many calculators offer graphs and charts that visually represent your financial data, making it easier to spot trends and identify potential issues.

Choosing the Right Annual Financial Projection Calculator

With so many financial projection tools available, how do you choose the right one for your business? Here are some factors to consider:

- Ease of Use: Look for a tool that’s user-friendly and doesn’t require a background in finance to operate.

- Customizability: The best calculators allow you to customize the inputs and outputs to suit your unique business model.

- Comprehensive Reporting: Your financial projection tool should provide detailed reports, including balance sheets, income statements, and cash flow summaries.

- Integration with Accounting Software: If you’re using accounting software like QuickBooks or Xero, it’s beneficial to choose a calculator that integrates seamlessly with these platforms.

- Cost: Some financial projection calculators are free, while others require a subscription. Consider your budget and choose the tool that offers the best value for your business.

Common Mistakes When Using an Annual Financial Projection Calculator

While an annual financial projection calculator is a powerful tool, many business owners make mistakes when using it. Avoid these common pitfalls to ensure your projections are accurate and actionable:

- Relying Too Heavily on Assumptions: Financial projections are only as good as the data you put in. Avoid making overly optimistic assumptions, especially when it comes to revenue growth or cost reductions.

- Ignoring External Factors: Consider external factors like market trends, economic conditions, and regulatory changes that could impact your business. These factors can significantly alter your financial outlook.

- Not Revisiting Projections Regularly: Your business’s financial situation can change quickly. Review and update your projections regularly to ensure they remain relevant and useful.

How an Annual Financial Projection Calculator Can Aid in Budget Planning

Budget planning is a crucial component of business management, and an annual financial projection calculator can play a central role in this process. By providing a clear view of expected income and expenses, the calculator enables businesses to allocate resources more effectively, control spending, and avoid overextending themselves financially.

One key feature that makes the annual financial projection calculator indispensable for budgeting is its ability to break down finances on a monthly or quarterly basis. This allows business owners to monitor their finances in real-time, adjusting their budget as needed throughout the year.

Another important aspect is the ability to project various scenarios. For example, if you anticipate a significant capital expense halfway through the year, the calculator can help you determine how this investment will impact your budget and whether your business will still have the funds to cover day-to-day operations.

Optimizing the Use of an Annual Financial Projection Calculator for Business Growth

While the annual financial projection calculator provides immense value for day-to-day financial management, it’s also a powerful tool for fostering long-term business growth. To optimize its use, business owners and finance managers need to go beyond merely entering numbers. Here are some strategies to ensure that your projections not only reflect your business’s current financial state but also support your growth plans:

1. Perform Sensitivity Analysis Regularly

One of the most effective ways to optimize the use of a financial projection calculator is by running sensitivity analyses. This means creating different financial projections based on varying assumptions. For example, what happens if your revenue grows by 10%, or what if it shrinks by 5% due to market fluctuations? Running multiple scenarios helps you understand the potential impacts of both optimistic and pessimistic outcomes, allowing you to prepare accordingly.

Regular sensitivity analysis is especially critical for businesses in volatile industries, where external factors like market demand or regulatory changes can significantly affect income or costs. It’s like preparing for both a sunny day and a rainy day—financially speaking. Having contingency plans based on different projections ensures that you can react swiftly and appropriately, minimizing risks to your business.

2. Leverage the Power of Historical Data

Your financial history is one of the most powerful tools you have when using an annual financial projection calculator. By analyzing past revenue, expenses, and profit margins, you can make much more informed projections about the future. Look for patterns in your historical data: Are sales higher in certain months? Do you typically have higher costs in the last quarter? Understanding these trends will enable you to create more accurate forecasts and budget more effectively.

Historical data doesn’t just help with projections—it also helps with tracking performance. As you move through the year, comparing your actual performance with your projections allows you to make timely adjustments. If your revenues are falling short of projections, for example, you might decide to ramp up marketing efforts or find ways to reduce costs to stay on track.

3. Incorporate Market and Industry Trends

While historical data is critical, future projections must also account for upcoming trends and shifts in your industry. For instance, if you’re in the retail business, it’s essential to forecast how consumer behavior might change due to evolving e-commerce trends. In industries like technology, regulatory changes, or new technological advancements might have significant implications for your projections.

When using an annual financial projection calculator, you should also consider market research reports and economic forecasts. If the economy is expected to slow down, for example, factor in the potential impact on your revenue. Conversely, if there’s strong demand in your industry or a new market opportunity opening up, reflect that in your projections. In this way, the calculator can help you plan for both growth and adaptation.

Industries That Benefit Most from Financial Projection Calculators

While virtually all businesses can benefit from using an annual financial projection calculator, certain industries may find it particularly beneficial. Here are a few examples of industries that can use this tool to great effect:

1. Manufacturing Industry

Manufacturing companies deal with significant capital expenditures, raw materials costs, labor, and machinery upkeep, all of which can fluctuate based on market conditions. An annual financial projection calculator allows manufacturers to map out different cost scenarios based on fluctuating material prices or potential supply chain disruptions. They can project how these variables affect cash flow and profitability, which is crucial for ensuring production continues smoothly.

2. Retail and E-commerce

For retail and e-commerce businesses, sales cycles can fluctuate dramatically throughout the year, especially around holidays, seasonal sales, or other peak shopping periods. Using a financial projection calculator, these businesses can forecast income during high-sales periods and ensure they have enough inventory and staffing to meet demand. They can also use the tool to plan for quieter periods, ensuring they have the cash reserves to cover operating costs when revenue dips.

3. Real Estate

The real estate industry, which often involves large, one-off transactions and long periods between deals, relies heavily on cash flow management. An annual financial projection calculator can help real estate companies predict when income from property sales or leases will arrive and align this with ongoing expenses. It can also aid in long-term planning for property development projects, accounting for financing costs, construction timelines, and eventual returns on investment.

4. Startups

Startups, especially in the early stages, often face unpredictable revenues and high operating costs. For startups seeking venture capital or bank loans, having a detailed financial projection is crucial. Investors want to see how a business plans to grow and when it expects to become profitable. Using an annual financial projection calculator, startups can provide potential investors with credible forecasts that highlight the business’s potential and growth strategy.

How Small Businesses Can Leverage Financial Projection Tools

For small businesses, managing cash flow and planning for the future is one of the biggest challenges. Here’s how small business owners can make the most out of an annual financial projection calculator:

1. Simplify Budgeting

Budgeting is critical for small businesses, and using an annual financial projection calculator can simplify this process. By inputting expected revenues and expenses, small businesses can create a working budget for the year, allowing them to allocate funds toward operational costs, marketing, expansion, and other essential areas. Small businesses often face resource constraints, so an accurate financial projection ensures every dollar is spent wisely.

Moreover, the calculator allows small businesses to make adjustments mid-year based on actual performance. If revenue is higher than expected, they can reinvest in growth opportunities. Conversely, if expenses are rising faster than projected, they can cut back or delay discretionary spending.

2. Plan for Tax Obligations

Small businesses are especially vulnerable to tax-related challenges, given their limited cash flow. A comprehensive financial projection includes estimated tax obligations, helping small business owners prepare for quarterly and annual tax filings. This ensures that they are not caught off guard by large tax bills at the end of the year, which can strain their finances.

Additionally, by forecasting profits, small businesses can better understand their tax liabilities and make smarter decisions about reinvesting earnings or distributing profits.

3. Managing Seasonal Cash Flow

Many small businesses, especially those in retail, tourism, and agriculture, experience seasonal fluctuations in revenue. An annual financial projection calculator can help manage these swings by forecasting revenue for peak seasons and planning for leaner times. By doing so, businesses can make sure they have enough cash reserves to cover operational costs during off-seasons.

The calculator can also help businesses determine the best time to make investments or take on additional costs. For example, a retail store might use a financial projection calculator to plan for increased inventory during the holiday shopping season, ensuring they have enough stock on hand without overspending.

4. Securing Loans or Investment

Small businesses often need additional capital to grow, whether through a bank loan or investment from outside sources. To secure funding, financial institutions and investors typically ask for detailed financial projections. An annual financial projection calculator can generate the kind of data needed to reassure lenders or investors that your business is on the right track.

A well-crafted projection demonstrates to potential investors that your business understands its financial needs, has clear growth goals, and has the capacity to repay loans or deliver returns on investment.

For more information regarding Finance Basic you can visit FinancewithAi Channel & Home

FAQs

What is an annual financial projection calculator used for?

An annual financial projection calculator is used to estimate a business’s future financial performance by projecting revenue, expenses, and cash flow for the upcoming year.

How can a financial projection calculator help my business?

A financial projection calculator helps businesses plan for future expenses, manage cash flow, set realistic financial goals, and attract investors by providing detailed financial forecasts.

Is it necessary to update financial projections regularly?

Yes, regularly updating financial projections is crucial to ensure that your business’s financial plan remains accurate in response to changing market conditions or internal factors.

What’s the difference between an annual financial projection and a budget?

A financial projection estimates a business’s future financial performance, while a budget is a plan that allocates resources based on expected income and expenses.

Can I use an annual financial projection calculator for personal finances?

Yes, individuals can use an annual financial projection calculator to manage personal finances, especially if they have multiple income sources or complex expenses.

What features should I look for in a financial projection calculator?

Look for ease of use, comprehensive reporting, scenario analysis, cash flow tracking, and integration with accounting software when choosing a financial projection calculator.

Conclusion

An annual financial projection calculator is an invaluable tool for both business owners and individuals. It provides a detailed picture of your financial future, helping you make informed decisions and prepare for challenges. By using this calculator to forecast your income, expenses, and cash flow, you can improve your budgeting, set achievable goals, and ensure that your business remains on a path to growth. To get the most out of your financial projection, it’s essential to use accurate data, regularly update your projections, and choose a calculator that fits your specific needs.

Thank you for the detailed write-up! It was such an enjoyable read. I’d love to stay connected—how can we communicate further?

It feels like you’ve read my mind! You seem to know so much about this topic, as if you wrote the book on it. Adding some visuals could make it even more engaging. Excellent read—I’ll definitely be back!