The Complete Guide to Understanding the Candlestick Bible

The world of trading can be complex, but mastering tools like the Candlestick Bible can transform the experience into a more predictable and successful venture. In this comprehensive guide, we’ll explore everything you need to know about the Candlestick Bible, from its history and importance to practical applications in modern trading. Whether you’re a novice trader or a seasoned professional, this article will provide valuable insights to enhance your trading strategies.

What is the Candlestick Bible?

The Candlestick Bible is a renowned resource in the trading community, offering a deep dive into the art of reading candlestick charts. These charts are graphical representations of price movements in the stock market and other financial markets, providing traders with visual cues that help predict future market behavior. The Candlestick Bible is not just a book but a concept that has become essential for traders who wish to master candlestick patterns and enhance their decision-making skills.

The History Behind Candlestick Patterns

Candlestick patterns have a rich history dating back to 18th century Japan. Munehisa Homma, a rice trader from Sakata, is credited with developing these techniques. Homma’s success in trading was largely attributed to his ability to analyze market emotions and price movements using what we now call candlestick patterns. The Candlestick Bible builds on this ancient knowledge, organizing and systematizing it for modern traders.

Why the Candlestick Bible is Crucial for Traders

The Candlestick Bible is crucial for traders because it simplifies the complexity of the markets. By understanding and applying candlestick patterns, traders can gain a clearer picture of market sentiment, which is often a precursor to price movements. This knowledge is invaluable in making informed trading decisions, reducing risks, and increasing profitability.

Essential Candlestick Patterns Explained

The Candlestick Bible covers numerous candlestick patterns, each with its own significance. Some of the most essential patterns include:

- Doji: A candlestick that indicates indecision in the market. It’s characterized by a small body and long wicks, signaling that neither buyers nor sellers have control.

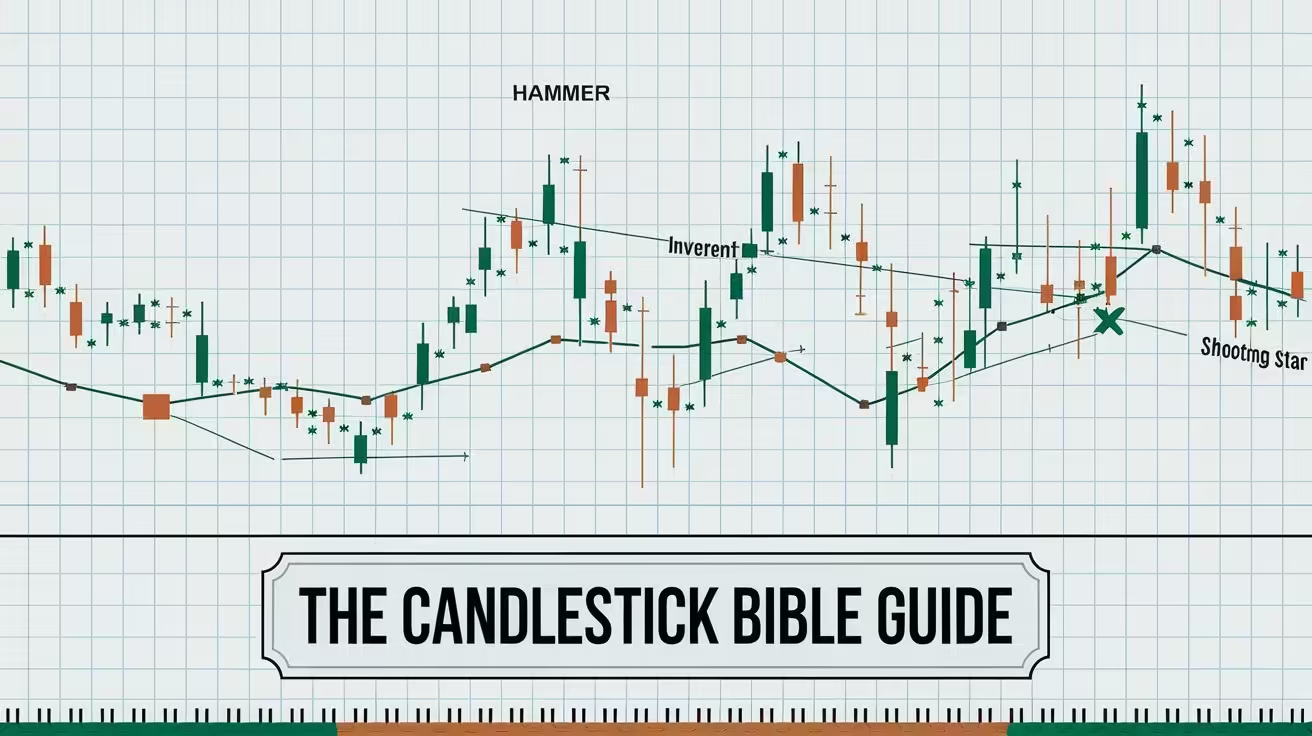

- Hammer: This pattern appears at the bottom of a downtrend and suggests a potential reversal. It has a small body and a long lower wick, showing that sellers drove prices down but buyers fought back to close near the opening price.

- Shooting Star: The opposite of the Hammer, this pattern occurs at the top of an uptrend and indicates a bearish reversal. It has a small body and a long upper wick, showing that buyers drove prices up but sellers forced them back down.

- Engulfing Patterns: Bullish engulfing occurs when a small bearish candle is followed by a larger bullish candle, signaling a potential reversal. The opposite is true for a bearish engulfing pattern.

Understanding these patterns and others detailed in the Candlestick Bible can significantly improve your ability to predict market movements.

How to Use the Candlestick Bible in Trading

Using the Candlestick Bible in trading involves more than just recognizing patterns. It requires a strategic approach to interpreting these patterns within the context of the overall market environment. Here’s how you can effectively use the Candlestick Bible:

Analyzing Market Trends

Before applying any candlestick pattern, it’s crucial to analyze the broader market trend. The Candlestick Bible emphasizes the importance of context—knowing whether the market is in an uptrend, downtrend, or sideways movement can influence the reliability of a pattern.

Confirmation with Other Indicators

The Candlestick Bible also recommends using other technical indicators in conjunction with candlestick patterns to confirm trading signals. For example, moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) can provide additional insights and reduce false signals.

Timing Your Trades

Timing is everything in trading, and the Candlestick Bible provides guidance on when to enter and exit trades. By understanding the psychology behind candlestick patterns, traders can better predict when a trend is about to change and act accordingly.

Risk Management

No trading strategy is complete without risk management, and the Candlestick Bible offers advice on setting stop-loss orders and managing position sizes. By minimizing potential losses, traders can protect their capital and stay in the game longer.

The Psychology Behind Candlestick Patterns

The Candlestick Bible delves into the psychology of market participants, explaining how emotions like fear and greed drive price movements. Each candlestick pattern reflects a battle between buyers and sellers, and by understanding this dynamic, traders can gain deeper insights into market behavior.

Advanced Techniques from the Candlestick Bible

For traders looking to take their skills to the next level, the Candlestick Bible offers advanced techniques that go beyond basic pattern recognition. These techniques include:

Combining Patterns for Stronger Signals

Sometimes, a single candlestick pattern may not provide a clear signal. The Candlestick Bible teaches how to combine multiple patterns to create stronger trading signals. For example, a Doji followed by a Bullish Engulfing pattern can be a powerful indicator of a trend reversal.

Integrating Fibonacci Levels

The Candlestick Bible also explores how to integrate Fibonacci retracement levels with candlestick patterns to identify potential support and resistance levels. This combination can enhance the accuracy of your trades.

Trading with Multiple Time Frames

Another advanced technique discussed in the Candlestick Bible is trading with multiple time frames. By analyzing patterns on different time frames, traders can gain a more comprehensive view of the market and make more informed decisions.

Common Mistakes to Avoid When Using the Candlestick Bible

Even with the knowledge contained in the Candlestick Bible, traders can make mistakes. Some common pitfalls include:

Overtrading

One of the most common mistakes is overtrading—entering too many trades based on candlestick patterns without sufficient confirmation from other indicators. The Candlestick Bible emphasizes quality over quantity.

Ignoring Market Conditions

Another mistake is ignoring broader market conditions. Even the most reliable candlestick pattern can fail in a volatile or news-driven market. The Candlestick Bible advises traders to always consider the larger market context.

Failing to Manage Risk

Risk management is crucial, yet many traders neglect it. The Candlestick Bible stresses the importance of setting stop-loss orders and managing position sizes to protect your trading capital.

Real-Life Applications of the Candlestick Bible

The principles outlined in the Candlestick Bible are not just theoretical—they have real-life applications in various markets, including stocks, forex, and cryptocurrencies. Let’s explore how traders have successfully applied these strategies.

Stock Market Success Stories

Many stock market traders have credited their success to the Candlestick Bible. By mastering patterns like the Hammer and Bullish Engulfing, they have been able to identify lucrative entry points and avoid costly mistakes.

Forex Trading with the Candlestick Bible

The fast-paced forex market is particularly well-suited to candlestick trading strategies. Traders who use the Candlestick Bible have found that it helps them navigate the volatility of currency pairs and make more informed decisions.

Cryptocurrency Trading Insights

Cryptocurrency markets are known for their volatility, making the Candlestick Bible an invaluable tool. Traders have used candlestick patterns to predict price movements in assets like Bitcoin and Ethereum, capitalizing on market swings.

The Evolution of the Candlestick Bible

The Candlestick Bible has evolved over the years, incorporating new insights and techniques as markets have changed. What began as a manual for rice traders in Japan has become a global phenomenon, with applications in virtually every financial market.

The Impact of Technology

Technology has played a significant role in the evolution of the Candlestick Bible. Advanced charting software and online trading platforms have made it easier than ever for traders to access and apply candlestick patterns.

The Future of Candlestick Trading

As markets continue to evolve, so too will the techniques outlined in the Candlestick Bible. The future of candlestick trading may involve the integration of artificial intelligence and machine learning to identify patterns and optimize trading strategies.

The Candlestick Bible: Mastering Essential Patterns

Candlestick charts, with their distinctive bodies and wicks, have become an indispensable tool for traders and investors alike. They visually represent price action over a specific period, providing insights into market sentiment, trends, and potential reversal points. In this comprehensive guide, we will delve into the “Candlestick Bible,” exploring five essential candlestick patterns that can significantly enhance your trading strategies.

1. Hammer and Hanging Man: Reversal Patterns

The Hammer and Hanging Man patterns are among the most recognizable candlestick formations, signaling potential reversals in a trend.

Hammer:

- Appearance: A small body with a long lower wick, resembling a hammer.

- Significance: Often indicates a bullish reversal after a downtrend. The long lower wick suggests that buyers were able to push the price higher, overcoming selling pressure.

Hanging Man:

- Appearance: A small body with a long upper wick, resembling a hanging man.

- Significance: Often indicates a bearish reversal after an uptrend. The long upper wick suggests that sellers were able to push the price lower, overcoming buying pressure.

Key Considerations:

- Volume: The volume accompanying these patterns is crucial. High volume can strengthen the signal, while low volume may indicate a false breakout.

- Confirmation: These patterns are often more reliable when followed by a reversal in price and a change in momentum.

2. Doji: Indecision and Neutral Signals

Doji candlesticks have a small or no body, with the opening and closing prices being nearly identical. They often signal indecision or a pause in the market.

Types of Doji:

- Dragonfly Doji: A long upper wick with a small or no body.

- Gravestone Doji: A long lower wick with a small or no body.

- Long-Legged Doji: Both upper and lower wicks are long.

Significance:

- Indecision: Dojis can indicate a battle between buyers and sellers, with neither side gaining a clear advantage.

- Potential Reversal: If a Doji appears after a significant uptrend or downtrend, it may signal a potential reversal.

- Continuation: In some cases, Dojis can indicate a pause in a trend before the trend resumes.

3. Engulfing Patterns: Strong Reversal Signals

Engulfing patterns are formed when a candlestick’s body completely engulfs the body of the previous candlestick. They are powerful reversal signals.

Bullish Engulfing Pattern:

- Appearance: A large bullish candlestick follows a smaller bearish candlestick, completely engulfing the previous candle’s body.

- Significance: Indicates a potential bullish reversal after a downtrend.

Bearish Engulfing Pattern:

- Appearance: A large bearish candlestick follows a smaller bullish candlestick, completely engulfing the previous candle’s body.

- Significance: Indicates a potential bearish reversal after an uptrend.

Key Considerations:

- Volume: High volume accompanying an engulfing pattern strengthens the signal.

- Confirmation: A subsequent price movement in the direction of the engulfing pattern confirms the reversal.

4. Shooting Star and Inverted Hammer: Top Reversal Patterns

The Shooting Star and Inverted Hammer are candlestick patterns that often signal potential tops in an uptrend.

Shooting Star:

- Appearance: A small body with a long upper wick, followed by a lower body.

- Significance: Indicates a potential top reversal, as sellers were able to push the price lower after a period of buying pressure.

Inverted Hammer:

- Appearance: A small body with a long lower wick, followed by a higher body.

- Significance: Similar to the Shooting Star, it can indicate a potential top reversal.

5. Morning Star and Evening Star: Reversal Patterns

The Morning Star and Evening Star patterns are three-candlestick formations that signal potential reversals.

Morning Star:

- Appearance: A small bearish candlestick (star) is followed by a larger bullish candlestick, and then another bullish candlestick.

- Significance: Indicates a potential bullish reversal after a downtrend.

Evening Star:

- Appearance: A small bullish candlestick (star) is followed by a larger bearish candlestick, and then another bearish candlestick.

- Significance: Indicates a potential bearish reversal after an uptrend.

Key Considerations:

- Gaps: Gaps between the candlesticks can strengthen the signal.

- Volume: High volume on the second and third candlesticks can confirm the reversal.

Beyond the Basics: Advanced Candlestick Patterns

While the five patterns discussed above form the foundation of candlestick analysis, there are numerous other formations that can provide valuable insights into market behavior. Here are a few additional candlestick patterns to consider:

1. Dark Cloud Cover and Piercing Line: Continuation Patterns

These patterns are often used to identify potential continuations of existing trends.

Dark Cloud Cover:

- Appearance: A bullish candlestick is followed by a large bearish candlestick that opens above the previous candle’s high but closes below the previous candle’s low.

- Significance: Indicates a potential bearish reversal within an uptrend.

Piercing Line:

- Appearance: A bearish candlestick is followed by a large bullish candlestick that opens below the previous candle’s low but closes above the previous candle’s high.

- Significance: Indicates a potential bullish reversal within a downtrend.

2. Three Crows and Three White Soldiers: Trend Continuation Patterns

These patterns suggest a continuation of the existing trend.

Three Crows:

- Appearance: Three consecutive bearish candlesticks with small bodies and long upper wicks, appearing as crows.

- Significance: Indicates a potential bearish continuation within a downtrend.

Three White Soldiers:

- Appearance: Three consecutive bullish candlesticks with small bodies and long lower wicks, appearing as soldiers.

- Significance: Indicates a potential bullish continuation within an uptrend.

3. Harami Patterns: Indecision and Potential Reversal

Harami patterns signal indecision or potential reversals.

Bullish Harami:

- Appearance: A small bullish candlestick appears within the body of a previous bearish candlestick.

- Significance: Indicates a potential bullish reversal within a downtrend.

Bearish Harami:

- Appearance: A small bearish candlestick appears within the body of a previous bullish candlestick.

- Significance: Indicates a potential bearish reversal within an uptrend.

4. Inside Bars and Outside Bars: Range-Bound or Breakout Signals

These patterns can indicate either a range-bound market or a potential breakout.

Inside Bar:

- Appearance: A candlestick that is completely contained within the previous candlestick’s high and low.

- Significance: Indicates indecision or a potential range-bound market.

Outside Bar:

- Appearance: A candlestick that extends beyond the previous candlestick’s high and low.

- Significance: Indicates a potential breakout from a range.

5. Tweezer Tops and Tweezer Bottoms: Reversal Patterns

Tweezer patterns are formed when two consecutive candlesticks have identical highs or lows.

Tweezer Top:

- Appearance: Two consecutive candlesticks with identical highs.

- Significance: Indicates a potential top reversal.

Tweezer Bottom:

- Appearance: Two consecutive candlesticks with identical lows.

- Significance: Indicates a potential bottom reversal.

Additional Considerations:

- Timeframe: The timeframe of the chart can influence the significance of candlestick patterns. For example, a pattern on a daily chart may have a different impact than the same pattern on a 1-hour chart.

- Context: Consider the broader market context when analyzing candlestick patterns. Factors such as economic news, industry trends, and technical indicators can provide additional insights.

- Combination with Other Indicators: Candlestick patterns can be combined with other technical indicators, such as moving averages, relative strength index (RSI), or Bollinger Bands, to enhance trading decisions.

FAQs about the Candlestick Bible

What is the Candlestick Bible?

The Candlestick Bible is a comprehensive guide to understanding and applying candlestick patterns in trading. It helps traders predict market movements by analyzing price action and market psychology.

Can beginners use the Candlestick Bible?

Yes, the Candlestick Bible is suitable for traders of all levels. It starts with basic patterns and concepts before moving on to more advanced techniques.

How can I apply the Candlestick Bible to forex trading?

The Candlestick Bible can be applied to forex trading by using it to identify key patterns that signal potential reversals or continuations in currency pairs.

Is the Candlestick Bible only for stock trading?

No, the Candlestick Bible can be applied to various markets, including stocks, forex, commodities, and cryptocurrencies.

What are some advanced techniques in the Candlestick Bible?

Advanced techniques include combining multiple candlestick patterns, integrating Fibonacci levels, and trading across multiple time frames.

How does the Candlestick Bible help with risk management?

The Candlestick Bible provides strategies for setting stop-loss orders and managing position sizes, which are essential for minimizing risk in trading.

Conclusion

The Candlestick Bible is more than just a book—it’s a powerful tool that has stood the test of time. By mastering the patterns and techniques outlined in this guide, traders can gain a significant edge in the markets. Whether you’re trading stocks, forex, or cryptocurrencies, the Candlestick Bible offers valuable insights that can help you make smarter, more informed decisions. With its emphasis on psychology, pattern recognition, and risk management, the Candlestick Bible is an essential resource for anyone serious about trading.

For more information regarding Finance Basic you can visit FinancewithAi Channel & Home

Hammer Candlestick Pattern: 7 Powerful Tips for Successful Trading

10 Gravestone Doji Candle Secrets That Will Boost Your Trading Success

5 Powerful Ways the Inverted Hammer Candle Pattern Can Boost Your Trading Success

Dragonfly Doji Candlestick: 7 Powerful Reasons It Signals a Positive Market Reversal

The Candlestick Bible is not just a tool for traders; it’s a comprehensive guide that has the potential to transform your trading journey. Whether you’re looking to refine your strategies or start from scratch, this resource will provide the knowledge and confidence you need to succeed.