A Comprehensive Guide to the Evening Star Pattern in Technical Analysis

In the dynamic world of trading, understanding market trends and patterns can be the key to success. One such critical pattern is the Evening Star Pattern. This formation, often used by traders and analysts, can provide significant insights into potential market reversals, offering an opportunity to make informed decisions.

The Evening Star Pattern is a popular candlestick pattern that signals a bearish reversal, indicating that the market may be preparing to shift from an uptrend to a downtrend. This pattern is especially relevant in technical analysis, where traders rely on historical price data to forecast future movements. In this article, we will explore the intricacies of the Evening Star Pattern, how it forms, its significance, and how you can incorporate it into your trading strategy.

Understanding the Evening Star Pattern

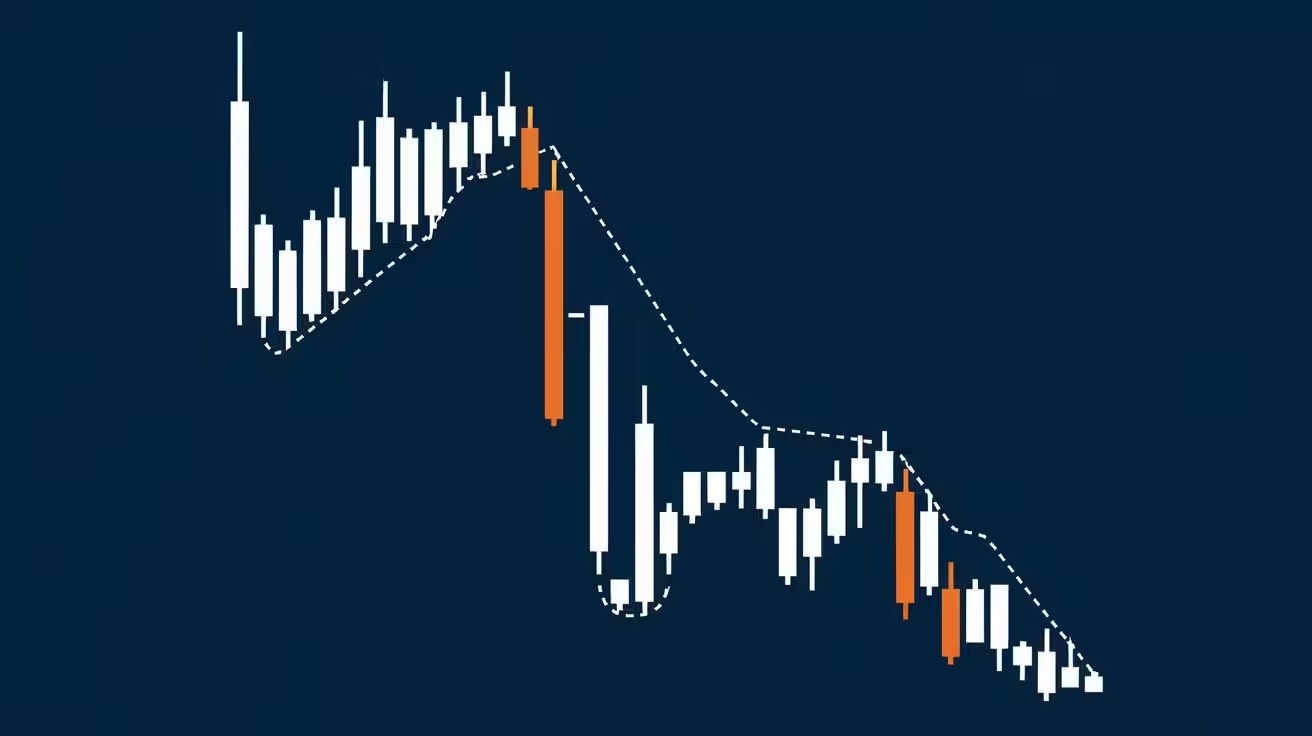

The Evening Star Pattern is a three-candlestick pattern that typically appears at the top of an uptrend. It is considered one of the most reliable indicators of a bearish reversal, often signaling the end of an upward price movement and the beginning of a potential downtrend. Traders and analysts value this pattern for its accuracy and reliability, making it a crucial tool in technical analysis.

Components of the Evening Star Pattern

The Evening Star Pattern consists of three distinct candlesticks:

- The Bullish Candle: The first candle in the Evening Star Pattern is a large bullish candle, reflecting strong upward momentum. This candle typically has a long body and little to no shadows, indicating that buyers are in control and pushing prices higher.

- The Star Candle: The second candle is the “star,” which is a small-bodied candle that can be either bullish or bearish. This candle forms above the close of the first candle, signaling a potential shift in market sentiment. The star candle often has long shadows, suggesting indecision among traders.

- The Bearish Candle: The third candle is a large bearish candle that closes below the midpoint of the first candle’s body. This candle confirms the bearish reversal, indicating that sellers have taken control and are driving prices lower.

Morning Star Candlestick Pattern: Discover 5 Profitable Trading Strategies

Formation of the Evening Star Pattern

The Evening Star Pattern forms over three trading periods:

- First Period: The market is in an uptrend, and the first candle is a strong bullish candle. This candle represents the continuation of the upward momentum, with buyers in control.

- Second Period: The market opens higher, but the momentum begins to weaken, leading to the formation of the star candle. This candle’s small body indicates indecision, as neither buyers nor sellers dominate the market. The long shadows suggest a tug-of-war between the bulls and bears.

- Third Period: The market opens lower, and the bearish candle forms. This candle closes below the midpoint of the first candle, confirming the bearish reversal and signaling that sellers have taken over.

Significance of the Evening Star Pattern

The Evening Star Pattern is significant because it provides a clear signal of a potential market reversal. When this pattern appears at the top of an uptrend, it suggests that the bullish momentum is waning and that a bearish trend may be on the horizon. This pattern is particularly valuable for traders looking to capitalize on short-selling opportunities or to exit long positions before a downtrend begins.

How to Identify the Evening Star Pattern

To identify the Evening Star Pattern, traders should look for the following criteria:

- The first candle must be a large bullish candle, indicating strong upward momentum.

- The second candle, the star, should have a small body and form above the first candle’s close. The star can be either bullish or bearish, but its small size indicates indecision.

- The third candle must be a large bearish candle that closes below the midpoint of the first candle. This confirms the bearish reversal.

When these conditions are met, the Evening Star Pattern is considered valid, and traders can use it to make informed trading decisions.

Trading Strategies Using the Evening Star Pattern

The Evening Star Pattern is a powerful tool in a trader’s arsenal, offering a reliable signal for bearish reversals. However, like all technical indicators, it should be used in conjunction with other tools and analysis methods to maximize its effectiveness. Here, we will explore various trading strategies that incorporate the Evening Star Pattern.

1. Confirming the Evening Star Pattern with Volume

One way to enhance the reliability of the Evening Star Pattern is by confirming it with trading volume. Volume is a critical indicator of market strength, and it can provide valuable insights into the validity of a pattern.

- High Volume on the Bearish Candle: When the third candle in the Evening Star Pattern forms with high trading volume, it indicates strong selling pressure. This confirmation suggests that the bearish reversal is likely to be significant and sustained.

- Low Volume on the Star Candle: If the star candle forms on low volume, it reinforces the idea of indecision in the market. This low volume suggests that the initial bullish momentum is losing steam, increasing the likelihood of a reversal.

2. Combining the Evening Star Pattern with Other Indicators

While the Evening Star Pattern is a reliable indicator on its own, combining it with other technical indicators can provide additional confirmation and improve trading accuracy.

- Relative Strength Index (RSI): The RSI is a momentum oscillator that measures the speed and change of price movements. When the Evening Star Pattern appears and the RSI is in overbought territory (above 70), it provides a strong signal that a bearish reversal is imminent.

- Moving Averages: Moving averages can help identify the overall trend and provide additional confirmation for the Evening Star Pattern. For example, if the pattern forms near a key moving average, such as the 50-day or 200-day moving average, it may signal a significant reversal.

3. Setting Stop-Loss and Take-Profit Levels

Effective risk management is crucial in trading, and the Evening Star Pattern can help traders set appropriate stop-loss and take-profit levels.

- Stop-Loss Placement: A stop-loss order should be placed above the high of the star candle. This placement protects against false signals and limits potential losses if the pattern fails.

- Take-Profit Targets: Traders can set take-profit targets based on previous support levels or Fibonacci retracement levels. By identifying key levels where the price may encounter support, traders can lock in profits before a potential reversal.

4. Using the Evening Star Pattern in Different Timeframes

The Evening Star Pattern can be applied across various timeframes, from intraday charts to weekly or monthly charts. However, the significance of the pattern may vary depending on the timeframe used.

- Shorter Timeframes: In shorter timeframes, such as 5-minute or 15-minute charts, the Evening Star Pattern may provide quick trading opportunities for day traders. However, these patterns may be more prone to false signals, so additional confirmation is essential.

- Longer Timeframes: In longer timeframes, such as daily or weekly charts, the Evening Star Pattern carries more weight and is less likely to produce false signals. Traders can use these patterns to identify significant trend reversals and make longer-term trading decisions.

10 Powerful Candlestick Patterns Cheat Sheet for Ultimate Trading Success

Real-World Examples of the Evening Star Pattern

To fully grasp the power and reliability of the Evening Star Pattern, let’s examine some real-world examples where this pattern has played a crucial role in market reversals.

Example 1: Evening Star Pattern in Stock Trading

Consider a scenario where a popular technology stock is in a strong uptrend, with its price rising steadily over several weeks. On the daily chart, a large bullish candle forms, followed by a star candle with a small body. The next day, a large bearish candle forms, closing below the midpoint of the first bullish candle. This sequence completes the Evening Star Pattern, signaling a potential reversal.

In this case, traders who identified the pattern early could have taken advantage of the impending downtrend by shorting the stock or exiting their long positions. As expected, the stock’s price began to decline in the following days, validating the Evening Star Pattern’s bearish signal.

10 Gravestone Doji Candle Secrets That Will Boost Your Trading Success

Example 2: Evening Star Pattern in Forex Trading

In the foreign exchange market, the Evening Star Pattern can also be a valuable tool for identifying trend reversals. For example, suppose the EUR/USD currency pair is in an uptrend, with the price rising consistently. On the 4-hour chart, a strong bullish candle forms, followed by a star candle. The next candle is a large bearish candle that closes below the midpoint of the first bullish candle, completing the Evening Star Pattern.

Traders who recognized this pattern could have entered short positions, anticipating a decline in the EUR/USD pair. As the price began to drop, these traders could have profited from the reversal, demonstrating the effectiveness of the Evening Star Pattern in forex trading.

Example 3: Evening Star Pattern in Cryptocurrency Trading

The Evening Star Pattern is not limited to traditional markets; it can also be applied to cryptocurrency trading. For instance, imagine Bitcoin is in an uptrend, with its price climbing steadily on the daily chart. A large bullish candle forms, followed by a star candle, and then a large bearish candle that closes below the midpoint of the first bullish candle.

This pattern suggests a potential reversal in Bitcoin’s price, providing an opportunity for traders to capitalize on a bearish move. Those who acted on this signal could have avoided losses or even profited from a short position as Bitcoin’s price began to decline.

5 Powerful Ways the Inverted Hammer Candle Pattern Can Boost Your Trading Success

Advantages and Limitations of the Evening Star Pattern

Like any technical analysis tool, the Evening Star Pattern has its advantages and limitations. Understanding these can help traders use the pattern more effectively and avoid potential pitfalls.

Advantages of the Evening Star Pattern

- High Accuracy: The Evening Star Pattern is known for its high accuracy in predicting bearish reversals. When confirmed with other indicators or volume, it can provide a reliable signal for traders.

- Ease of Identification: The pattern is relatively easy to identify on candlestick charts, making it accessible to both novice and experienced traders.

- Applicability Across Markets: The Evening Star Pattern can be used in various financial markets, including stocks, forex, and cryptocurrencies. Its versatility makes it a valuable tool for traders in different asset classes.

- Short and Long-Term Use: The pattern can be applied to multiple timeframes, allowing traders to use it for both short-term and long-term trading strategies.

Limitations of the Evening Star Pattern

- False Signals: Like all technical indicators, the Evening Star is not infallible. It can produce false signals, especially in volatile markets or shorter timeframes. Traders should use additional confirmation to reduce the risk of false signals.

- Reliance on Market Conditions: The pattern is most effective in trending markets. In a ranging market, where prices move sideways, the Evening Star may be less reliable.

- Lagging Indicator: The Evening Star Pattern is a lagging indicator, meaning it signals a reversal after it has already begun. While this can still provide profitable opportunities, it may result in late entries.

FAQs About the Evening Star

What is the Evening Star?

The Evening Star Pattern is a three-candlestick formation that signals a bearish reversal at the top of an uptrend. It consists of a large bullish candle, a small star candle, and a large bearish candle.

How reliable is the Evening Star?

The Evening Star Pattern is considered highly reliable, especially when confirmed with other technical indicators or volume. However, like all patterns, it can produce false signals, so additional confirmation is recommended.

Can the Evening Star be used in all markets?

Yes, the Evening Star can be used in various financial markets, including stocks, forex, and cryptocurrencies. Its versatility makes it a valuable tool for traders across different asset classes.

What timeframe is best for using the Evening Star?

The Evening Star Pattern can be applied to multiple timeframes, from intraday charts to weekly or monthly charts. The significance of the pattern increases with longer timeframes, where it is less prone to false signals.

How can I confirm the Evening Star?

To confirm the Evening Star Pattern, traders can use additional technical indicators such as RSI, moving averages, or volume. High volume on the bearish candle or overbought conditions in RSI can provide strong confirmation.

What are the limitations of the Evening Star?

The Evening Star Pattern can produce false signals, especially in volatile or ranging markets. It is also a lagging indicator, signaling a reversal after it has begun, which may result in late entries.

What is the Evening Star?

The Evening Star is a three-candlestick reversal pattern that often signals a potential bearish reversal after an uptrend. It consists of a small bullish candlestick (the star), followed by a larger bearish candlestick, and then another bearish candlestick.

How is the Evening Star formed?

To form an Evening Star Pattern, the following conditions must be met:

The first candlestick is a small bullish candlestick.

The second candlestick is a larger bearish candlestick that opens above the previous candle’s high but closes below the previous candle’s low.

The third candlestick is another bearish candlestick that closes below the second candlestick’s low.

What does the Evening Star signify?

The Evening Star Pattern suggests that selling pressure has overcome buying pressure, indicating a potential reversal from an uptrend to a downtrend.

Is the Evening Star Pattern a reliable indicator?

The Evening Star Pattern is a reliable indicator of potential reversals, but it is not foolproof. It is important to consider other factors, such as volume, market conditions, and technical indicators, before making trading decisions.

How can I identify a valid Evening Star?

To identify a valid Evening Star Pattern, look for the following characteristics:

The first candlestick (the star) should be small relative to the second candlestick.

The second candlestick should have a significant gap between its opening and closing prices.

The third candlestick should close below the second candlestick’s low.

What are the key factors to consider when trading the Evening Star?

When trading the Evening Star Pattern, consider the following factors:

Volume: High volume on the second and third candlesticks can strengthen the signal.

Market context: Evaluate the broader market conditions and industry trends to confirm the reversal.

Risk management: Implement appropriate risk management strategies, such as stop-loss orders, to protect your capital.

Advanced Considerations

Are there variations of the Evening Star?

Yes, there are variations of the Evening Star Pattern, such as the Dark Cloud Cover and the Three Crows. These patterns share similar characteristics but may have slightly different formations.

How can I combine the Evening Star with other technical indicators?

The Evening Star Pattern can be combined with other technical indicators, such as moving averages, relative strength index (RSI), or Bollinger Bands, to enhance trading decisions. For example, a moving average crossover or a divergence between price and RSI can provide additional confirmation of a reversal.

What are the potential risks associated with trading the Evening Star?

The Evening Star Pattern is not always a reliable indicator, and false signals can occur. It is essential to manage risk effectively and conduct thorough research before making trading decisions.

Additional Tips

Practice identifying the Evening Star on historical charts. This will help you become more familiar with its formation and recognize it in real-time.

Consider using a trading platform that provides automatic pattern recognition. This can save you time and help you identify potential Evening Star Patterns more easily.

Stay updated on market news and developments. Economic events, industry trends, and geopolitical factors can influence the effectiveness of the Evening Star Pattern.

Backtest your trading strategies using historical data. This will help you evaluate the performance of your trading ideas and make adjustments as needed.

Conclusion

The Evening Star Pattern is a powerful and reliable tool in technical analysis, offering traders valuable insights into potential bearish reversals. Its simplicity and accuracy make it a favorite among traders in various markets, from stocks to forex to cryptocurrencies. However, like all technical indicators, it should be used in conjunction with other tools and analysis methods to maximize its effectiveness.

By understanding the formation, significance, and application of the Evening Star Pattern, traders can enhance their ability to anticipate market reversals and make more informed trading decisions. Whether you’re a novice trader or an experienced analyst, incorporating the Evening Star Pattern into your trading strategy can help you navigate the markets with greater confidence and success.

For more information regarding Finance Basic you can visit FinancewithAi Channel & Home