The Definitive Guide to the Head and Shoulder Pattern in Trading

In the intricate world of financial markets, patterns are more than just visual representations; they are the footprints of market psychology. Among these, the head and shoulder pattern stands out as a powerful tool for traders, offering insights into potential market reversals. This article delves deep into the head and shoulder pattern, exploring its formation, significance, and how traders can leverage it for profitable decisions.

Understanding the Head and Shoulder Pattern

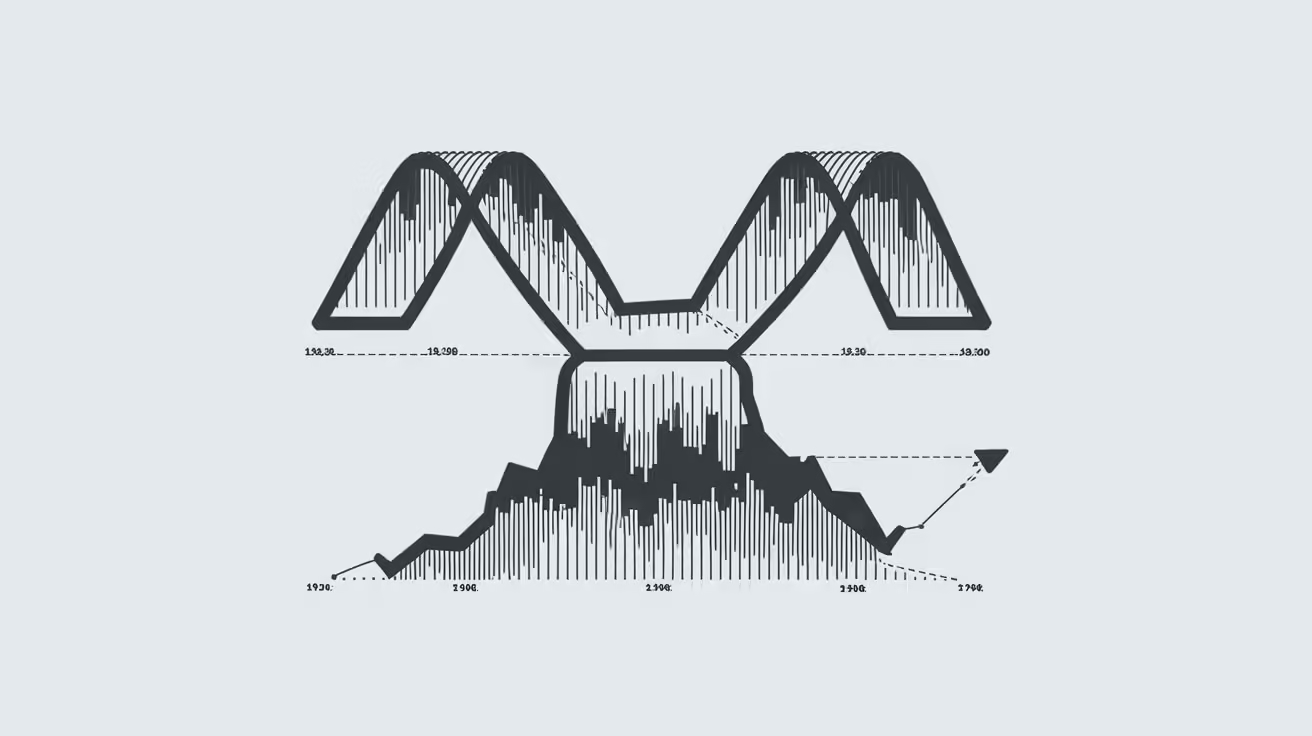

The head and shoulder pattern is a well-known chart formation that predicts a trend reversal, typically from a bullish to a bearish market. This pattern is recognized by its three peaks: a higher peak (the head) flanked by two lower peaks (the shoulders). These formations are essential to technical analysis, as they signal a shift in market sentiment.

The pattern forms when a stock’s price rises to a peak and subsequently declines. This first peak is the “left shoulder.” The price then rises again to form a higher peak (the “head”) before declining again. Finally, the price rises a third time, but only to the level of the first peak (the “right shoulder”), before declining once more.

The Anatomy of the Head and Shoulder Pattern

To fully grasp the head and shoulder pattern, one must understand its key components:

- Left Shoulder: The initial rise and subsequent fall create the left shoulder. This part of the pattern forms when the price moves upward, reflecting an increase in buying interest, but then hits resistance, leading to a pullback.

- Head: Following the left shoulder, the price experiences a more significant rise, driven by continued buying pressure. This peak is higher than the left shoulder, representing the head. However, after reaching this peak, the price declines again.

- Right Shoulder: The final rise in the pattern, forming the right shoulder, occurs after the decline from the head. This peak is typically lower than the head but at a similar level to the left shoulder, indicating weakening momentum among buyers.

- Neckline: The line connecting the lows of the left shoulder and the right shoulder is called the neckline. This line acts as a critical support level. When the price breaks below the neckline, it confirms the head and shoulder pattern, signaling a potential downward trend.

Why the Head and Shoulder Pattern Matters

The significance of the head and shoulder pattern lies in its ability to predict market reversals. For traders, recognizing this pattern early can mean the difference between capitalizing on a new trend or holding on to a losing position.

Reversal Indicator: The head and shoulder pattern is primarily a bearish reversal indicator, suggesting that an uptrend is nearing its end. When the pattern is completed and the price breaks below the neckline, it signals a potential decline in the price.

Market Psychology: The formation of the head and shoulder pattern reflects the battle between buyers and sellers. The left shoulder shows initial buying strength, the head indicates a peak in that buying pressure, and the right shoulder reveals a weakening of the bullish momentum as sellers gain control.

Profit Potential: Traders who identify a head and shoulder pattern early can prepare to short-sell or exit long positions before the market reverses. This pattern helps traders mitigate risk by offering a clear entry and exit strategy.

Variations of the Head and Shoulder Pattern

While the traditional pattern is the most common, there are variations that traders should be aware of:

Inverse Head and Shoulder Pattern: This variation occurs during a downtrend and signals a potential bullish reversal. In this case, the pattern forms with three troughs: the first and third are shallower, and the middle trough is the deepest. When the price breaks above the neckline, it confirms the reversal, indicating that the market may start an upward trend.

Complex Head and Shoulder Pattern: Sometimes, the pattern may include more than three peaks or troughs, creating a more complex structure. These patterns can still signal reversals but may require more careful analysis to identify correctly.

Trading the Head and Shoulder Pattern

Trading the head and shoulder pattern requires a keen eye and a well-defined strategy. Here’s how traders can effectively trade this pattern:

Identification: The first step is to accurately identify the pattern. Look for the three peaks (or troughs in the case of an inverse pattern) and the neckline. Ensure that the pattern is forming in an appropriate market context—typically, the head and shoulder pattern appears after a significant uptrend.

Confirmation: Wait for confirmation before entering a trade. This occurs when the price breaks below the neckline (or above it in the case of an inverse pattern). This breakout confirms that the reversal is likely underway.

Entry Point: After the neckline is broken, traders can enter a short position (or a long position in the case of an inverse pattern). Some traders might wait for a pullback to the neckline after the breakout, entering the trade at a more favorable price.

Stop Loss: A critical aspect of trading any pattern is risk management. Place a stop-loss order just above the right shoulder for a head and shoulder pattern, or just below it for an inverse pattern. This helps protect against unexpected market movements.

Profit Target: Determine a profit target by measuring the distance from the head to the neckline. This distance can be projected downward from the breakout point to estimate a potential profit target. However, traders should also consider other factors such as support and resistance levels.

Common Mistakes When Trading the Head and Shoulder Pattern

Even experienced traders can make mistakes when trading the head and shoulder pattern. Here are some common pitfalls to avoid:

Premature Entry: One of the biggest mistakes is entering a trade before the pattern is fully formed or before the neckline is broken. Premature entry can lead to losses if the pattern fails to complete or if the market reverses.

Ignoring Market Context: The head and shoulder pattern is most reliable in specific market contexts, particularly after a strong trend. Ignoring the broader market conditions can result in false signals.

Overreliance on the Pattern: While the head and shoulder pattern is a powerful tool, it should not be the sole basis for a trading decision. Combine it with other technical indicators and fundamental analysis to increase the likelihood of success.

Inadequate Risk Management: Failing to set appropriate stop-loss orders or neglecting to calculate risk-to-reward ratios can lead to significant losses. Always plan your trade and trade your plan.

Case Studies: The Head and Shoulder Pattern in Action

To better understand the application of the head and shoulder pattern, let’s examine some real-world case studies:

Example 1: The S&P 500 Index (2020)

In early 2020, the S&P 500 formed a classic head and shoulder pattern following a strong uptrend. The left shoulder formed in January, the head in February, and the right shoulder in early March. When the index broke below the neckline, it confirmed the bearish reversal, leading to a significant market decline exacerbated by the COVID-19 pandemic. Traders who recognized the pattern early and entered short positions were able to capitalize on the ensuing downtrend.

Example 2: Apple Inc. (AAPL) Stock (2012)

In 2012, Apple’s stock price exhibited an inverse head and shoulder pattern after a prolonged downtrend. The left shoulder formed in May, the head in June, and the right shoulder in July. The stock price broke above the neckline in August, confirming the bullish reversal. Apple’s stock went on to rally significantly, rewarding traders who recognized and acted on the pattern.

Advanced Techniques for Trading the Head and Shoulder Pattern

For seasoned traders looking to refine their strategy, there are advanced techniques to consider when trading the head and shoulder pattern:

Divergence Analysis: Divergence occurs when the price moves in the opposite direction of an indicator, such as the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD). In the context of a head and shoulder pattern, bearish divergence can reinforce the signal of an impending reversal.

Volume Analysis: Volume plays a crucial role in confirming the validity of a head and shoulder pattern. Typically, volume should increase on the breakout below the neckline. If volume is low during the breakout, it may indicate a false signal.

Multiple Time Frame Analysis: Analyzing the head and shoulder pattern across different time frames can provide additional confirmation. For example, if a pattern forms on a daily chart, checking the weekly chart for alignment can enhance the reliability of the signal.

Combining with Fibonacci Retracement: The Fibonacci retracement tool can help traders identify potential entry points or profit targets when trading the head and shoulder pattern. For example, after a breakout, a retracement to a key Fibonacci level (such as 38.2% or 61.8%) may offer a better entry point.

The Role of the Head and Shoulder Pattern in Modern Trading Strategies

In today’s fast-paced trading environment, the head and shoulder pattern remains a relevant and valuable tool for traders. Despite the rise of algorithmic trading and complex quantitative models, the fundamental principles of market psychology underpinning the head and shoulder pattern have not changed.

Integration with Algorithmic Trading: While the head and shoulder pattern is a traditional tool, it can be integrated into modern algorithmic trading strategies. By coding the pattern’s criteria into trading algorithms, traders can automate the identification and execution of trades based on this pattern.

Educational Value: For novice traders, the head and shoulder pattern serves as an excellent educational tool. Learning to identify and trade this pattern provides a foundation in technical analysis, market psychology, and risk management.

Versatility Across Markets: The head and shoulder pattern is not limited to equities; it can be applied across various markets, including forex, commodities, and cryptocurrencies. Its versatility makes it a valuable tool for traders in different asset classes.

The Future of the Head and Shoulder Pattern

As financial markets continue to evolve, the head and shoulder pattern is likely to remain a cornerstone of technical analysis. Its simplicity, combined with its effectiveness, ensures that it will continue to be used by traders for years to come.

Technological Advances: With advancements in trading technology, identifying and analyzing patterns like the head and shoulder will become even more accessible. Artificial intelligence and machine learning may further enhance the pattern’s accuracy by analyzing vast amounts of data and identifying subtle variations.

Continued Relevance: Despite the changing landscape of trading, the head and shoulder pattern’s relevance endures. As long as markets are driven by human psychology, patterns that reflect this psychology, like the head and shoulder, will remain valuable tools for traders.

FAQs

What is a head and shoulder pattern?

The head and shoulder pattern is a chart formation that signals a reversal from a bullish to a bearish trend. It consists of three peaks: a higher peak (the head) flanked by two lower peaks (the shoulders).

How reliable is the head and shoulder pattern?

The head and shoulder pattern is considered a reliable indicator of trend reversals, particularly in technical analysis. However, like all patterns, it is not foolproof and should be used in conjunction with other indicators.

Can the head and shoulder pattern occur in any market?

Yes, the head and shoulder pattern can occur in various markets, including equities, forex, commodities, and cryptocurrencies. Its principles apply across different asset classes.

What is the inverse head and shoulder pattern?

The inverse head and shoulder pattern is the opposite of the traditional pattern. It forms during a downtrend and signals a bullish reversal. It consists of three troughs, with the middle one being the deepest.

How do you confirm a head and shoulder pattern?

A head and shoulder pattern is confirmed when the price breaks below the neckline in a traditional pattern or above the neckline in an inverse pattern. Volume analysis can also help confirm the breakout.

Can head and shoulder patterns fail?

Yes, head and shoulder patterns can fail, particularly if the breakout does not occur or if the market context is not favorable. Risk management is crucial to protect against potential losses.

How do you identify a head and shoulder pattern?

To identify a head and shoulder pattern, look for three distinct peaks on a price chart. The first peak forms the left shoulder, followed by a higher peak, which is the head. The third peak, the right shoulder, is typically lower than the head but similar in height to the left shoulder. A neckline is drawn by connecting the lows between these peaks. When the price breaks below this neckline, the pattern is confirmed, signaling a potential bearish reversal.

What is the significance of the neckline in the head and shoulder pattern?

The neckline is a crucial component of the head and shoulder pattern. It represents the support level that connects the lows between the left shoulder, head, and right shoulder. The pattern is not considered complete until the price breaks below (or above in an inverse pattern) this neckline. The break of the neckline signals that the trend reversal is likely to occur, making it a key point for traders to consider entering or exiting positions.

What is an inverse head and shoulder pattern?

An inverse head and shoulder pattern is the opposite of the traditional head and shoulder pattern. It forms during a downtrend and signals a potential bullish reversal. Instead of peaks, this pattern consists of three troughs: the first and third troughs (the shoulders) are shallower, while the middle trough (the head) is the deepest. When the price breaks above the neckline of this pattern, it suggests that the market may start to trend upward.

How reliable is the head and shoulder pattern in predicting market movements?

The head and shoulder pattern is widely regarded as a reliable indicator of trend reversals, particularly in technical analysis. However, like all chart patterns, it is not infallible. The reliability of the pattern increases when confirmed by additional technical indicators, such as volume analysis or moving averages. It’s important for traders to consider the broader market context and to use proper risk management strategies when trading based on this pattern.

Can the head and shoulder pattern be used in all types of markets?

Yes, the head and shoulder pattern can be applied across various markets, including stocks, forex, commodities, and even cryptocurrencies. Its principles are based on market psychology, which is universal across different asset classes. However, traders should be mindful of the specific characteristics of each market, as the pattern may behave differently depending on factors such as volatility and liquidity.

What are the common mistakes traders make when using the pattern?

Some common mistakes include:

- Premature Entry: Entering a trade before the pattern is fully formed or before the neckline is broken can lead to false signals and potential losses.

- Ignoring Market Context: The head and shoulder pattern is most reliable in certain market conditions, particularly after a strong trend. Ignoring the broader market context can result in misinterpreting the pattern.

- Overreliance on the Pattern: While the head and shoulder pattern is a powerful tool, it should not be the sole basis for trading decisions. Traders should use it in conjunction with other technical and fundamental analysis tools.

- Inadequate Risk Management: Failing to set appropriate stop-loss orders or neglecting to calculate risk-to-reward ratios can lead to significant losses, especially if the pattern fails to complete or the market reverses unexpectedly.

How do volume and other indicators play a role in confirming the pattern?

Volume is a critical factor in confirming the head and shoulder pattern. Typically, volume should increase during the formation of the head and the break of the neckline. A significant increase in volume during the breakout enhances the likelihood that the pattern is valid and that the trend reversal will occur. Traders can also use other indicators like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) to confirm the strength of the signal.

What is the best strategy for trading the head and shoulder pattern?

The best strategy for trading the head and shoulder pattern involves several steps:

- Identification: Accurately identify the pattern by recognizing the three peaks and the neckline.

- Confirmation: Wait for the price to break below the neckline to confirm the pattern.

- Entry Point: Enter a short position after the neckline is broken. Some traders prefer to wait for a pullback to the neckline to enter at a more favorable price.

- Stop Loss: Place a stop-loss order just above the right shoulder to protect against unexpected market movements.

- Profit Target: Determine a profit target by measuring the distance from the head to the neckline and projecting it downward from the breakout point.

Can patterns fail, and how can traders protect themselves?

Yes, patterns can fail, particularly if the price does not break the neckline or if the market conditions change unexpectedly. To protect against potential losses, traders should always use stop-loss orders and avoid entering trades prematurely. Combining the head and shoulder pattern with other technical indicators and ensuring a thorough analysis of market conditions can also reduce the likelihood of failure.

Conclusion

The pattern remains a powerful tool in the arsenal of traders, offering insights into potential market reversals and opportunities for profit. Whether you’re a novice or an experienced trader, mastering this pattern can significantly enhance your trading strategy. By understanding its formation, significance, and application, you can better navigate the complexities of the financial markets and make informed trading decisions.

For more information regarding Finance Basic you can visit FinancewithAi Channel & Home